Posted: 02/07/2024 | BY: Jenna Bruce

Is Pet Insurance Worth It

When people ask, “Is pet insurance worth it,” what they really want to know is, “Will I get out of this what I pay into it?”

Obviously cost is a big factor for many people, especially in these hard economic times. But the reality is, you would never dream of not having health insurance for yourself or your two-legged family members. And that’s because none of us know when an illness or injury will strike.

The same is true with our pets. Serious accidents and illnesses happen in the blink of an eye, and we can be left facing a vet bill for thousands of dollars.

Check out this testimonial from one of our reviewers. Without pet insurance, she would have never been able to provide her fur baby with life-saving treatment! She would agree that pet insurance is TOTALLY worth it!

Did You Know…

According to NBC News, every 6 seconds in this country, a pet parent is faced with a vet bill of more than $1,000!

In addition, the American Pet Products Association’s National Pet Owners Survey reports that pet parents spend over 3x more on routine and surgical vet visits than they do on pet food.

And if you hope your fur baby won’t ever get sick or have a major accident, consider that 1-in-3 pets require emergency veterinary care every year.

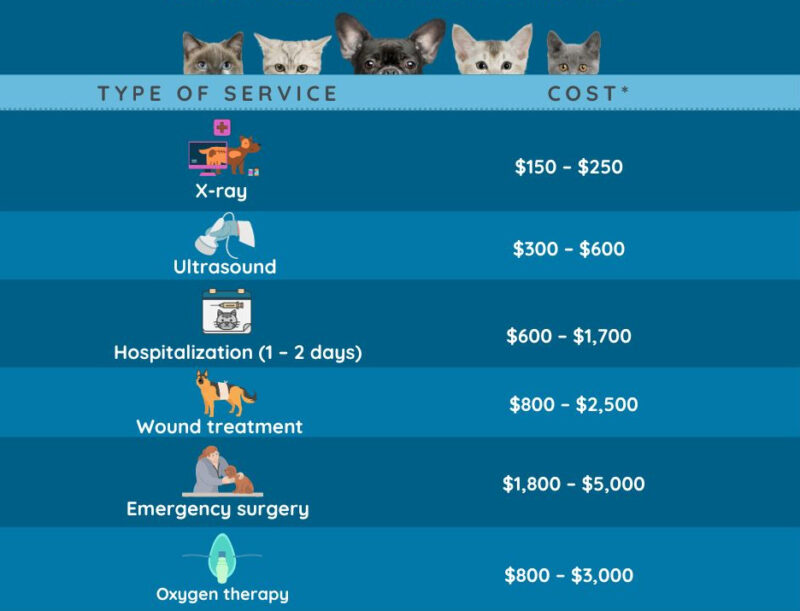

And just look at some of the average costs of emergency vet care in this country according to MetLife:

These are eye-opening statistics. And it’s important that pet parents know the reality of the costs associated with caring for their fur babies.

How Much Does Pet Insurance Cost?

“Can I afford pet insurance?” is a common question that is difficult to answer because everyone’s needs and budgets are different.

If you want to know how much it will cost for your specific pets, get a personalized quote here.

Pet insurance cost is based on your:

- Pet’s age (older pets are more expensive)

- Pet’s breed (some breeds are prone to hereditary diseases)

- Location (big cities have higher overall costs of living than smaller, rural areas)

- Pre-existing conditions

Pet insurance plans range from as little as $10 a month to as much as $200 a month. The more expensive plans have lower deductibles and will pay for more services without you having to pay out of pocket.

There can also be discounts for having more than one pet. And some insurance providers offer cashback if you buy your first policy within a certain period after the date your pet turns six months old.

Don’t Focus Solely on Premium Costs

As with most things in life, you get what you pay for. The cheaper pet insurance plans are not as comprehensive and are only meant for accident and illness coverage. Choosing a lower monthly premium will result in lower reimbursement rates and higher deductibles.

The higher-end plans are more expensive because in addition to covering accidents and sudden illnesses, they pay for preventive care and cover long-term illnesses as well. In general, most pet insurance policies cover vet visits.

I’m Not Sure How to Make the Best Financial Decision…

Here’s what we always say, “Go with the best coverage you can afford, because you can always downgrade your coverage at a later date if you need to .” Premiums will likely rise over time thanks to inflation, your dog’s age and other factors. Most insurance companies won’t penalize you if you need to drop down to a more affordable policy later. But if you need to upgrade your policy later on, you’ll most likely be subjected to underwriting again.

And if you’re overwhelmed with the number of pet insurance providers on the market, here are the top providers based on reviews from pet parents just like you:

Top Pet Insurance Providers of 2024

Rating Provider Total Review 4.9 Embrace 17,140 4.9 Healthy Paws 10,008 4.9 Trupanion 73,550 4.9 Fetch 18,308 4.9 Lemonade 805 4.8 Nationwide 21,407 4.8 Prudent Pet 125 4.7 Hartville 165 4.6 ManyPets 2,343 4.6 Pumpkin 1,473 4.6 Spot 7,024 4.5 ASPCA 11,756 4.5 PetPartners 113 4.4 AKC 891 4.3 Pet Assure 12 4.3 Pets Best 12,229 4.2 Figo 2,602 4.0 MetLife 652

What Does Pet Insurance Cover?

Most pet insurance plans cover treatments related to accidents and injuries, as well as treatment for cancer and other chronic conditions.

Here is a general list of what most pet insurance policies will cover:

- Surgery

- X-rays and diagnostic testing

- Prescription medications

- Cancer treatment

- Hospital stays

- Emergency care

- Arthritis

- Diabetes

- Parasites

- Broken bones and ligament tears

While these are commonly covered by most providers, bear in mind, every insurer has their own unique set of plans and coverage options.

It is essential to compare plans and make sure you understand the coverage details for the plan you choose.

Pet Insurance Review makes it easy to compare plans so you understand what each offers.

What’s Not Covered by Pet Insurance?

Most plans offered by pet insurance providers cover accidents and illness. They won’t cover things associated with preventative care, like vaccinations, spaying and neutering, dental cleanings, heartworm medications, or wellness checkups.

However, many providers now offer wellness plans that can be added onto your accident and illness plan to get help with the costs of preventative care.

Pet Insurance Exclusions

Most pet insurance companies exclude pre-existing conditions from coverage. This includes any diseases or injuries your pet acquired before their coverage began. Which is one of the reasons we always recommend pet parents enroll their pets when they are young and healthy. Not only will the premiums be lower, but you won’t be denied coverage due to a pre-existing condition.

So, Is Pet Insurance Worth It?

In 2022, 4.8 million pets were covered by pet insurance in the United States. That number was up 22% from the year before, according to the North American Pet health Insurance Association, or NAPHIA. So a lot of pet parents believe that yes, pet insurance is totally worth it.

But everyone is different and only you can decide if pet insurance is right for you.

In general, you should definitely consider pet insurance if:

- Your pet is young and healthy (you’ll get the lowest premiums available)

- You don’t have much savings or a large enough line of credit to cover a bill in the thousands of dollars

- Your pet is a certain breed that will likely experience hereditary health issues in the future

If your pet is a senior and already experiencing health issues (pre-existing conditions are not covered) or you are well-off financially and a hefty vet bill would not be a financial hardship for you, then pet insurance may not be worth it.

At Pet Insurance Review, we always recommend protecting your furry friend with pet insurance. From our point of view, and many other pet parents agree, there is no question: pet insurance is worth it for most people.

References:

- https://www.nbcnews.com/better/pop-culture/biggest-financial-shocks-pet-owners-how-avoid-them-ncna907146

- https://www.americanpetproducts.org/research-insights/appa-national-pet-owners-survey

- http://resource.carrollhospitalcenter.org/Documents/Pet%20Insurance%20(10-2017).pdf

- https://www.metlifepetinsurance.com/blog/pet-planning/emergency-vet-cost/